The Indian stock market responded with ecstatic jubilation today, with benchmark indices surging by over 5% after the Reserve Bank of India (RBI) surprised with a bigger-than-expected interest rate cut. The Nifty 50 and Sensex jumped, signaling market expectations that the central bank will continue to support the economy with higher growth, as inflation remains benign.

As of now, the Nifty 50 index was trading around 24,925.9, higher by about 175 points or 0.71% from its last close. The S&P BSE Sensex showed an even more dramatic gain, trading at roughly 82,021.64, higher by about 579.6 points or 0.71%. This shattering upward trajectory represents a dynamic close to the trading week, driven by the RBI’s impactful stance and action.

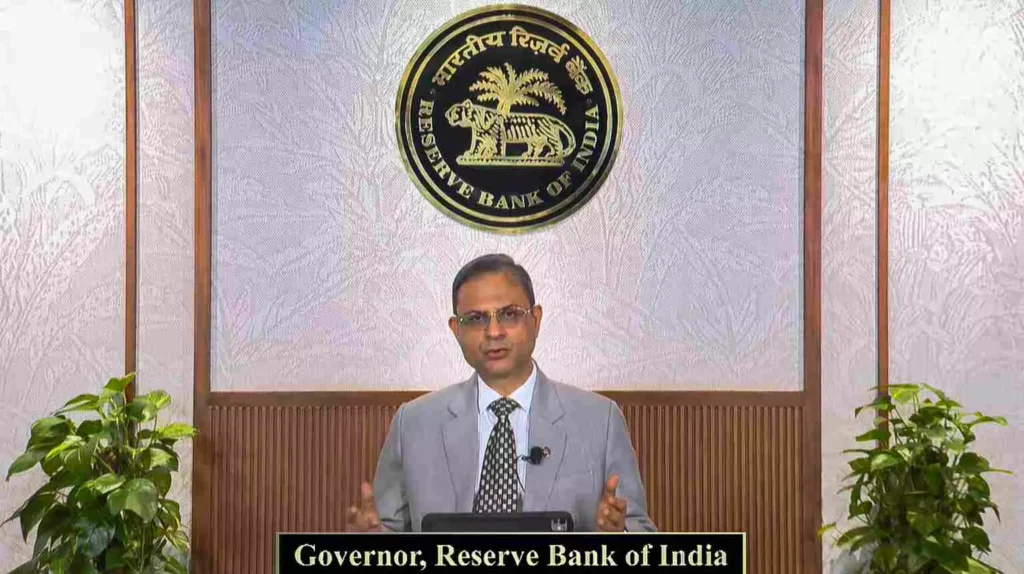

The most important development for the day was the decision by the Reserve Bank of India to cut interest rates by 50 bps. In a development that took the entire market by surprise, RBI Governor Sanjay Malhotra called for a 50 bps (3/5th of 1%) reduction in the repo rate which now stands at 5.50%. This waiver was the third cut in a row and a more aggressive move than the almost universally expected 25 bps cut. Parallel to this, the RBI lowered the Cash Reserve Ratio (CRR) by a hefty 100 bps from 4% to 3% a move that is likely to pump about Rs 2.5 lakh crore of primary liquidity into the banking system by November 2025.

Addressing World Bank economists, Governor Malhotra stressed that geopolitical tensions and weather vagaries are indeed headwinds, but the Indian economy does not grow at double the speed for long if that is the case. The MPC’s inflation forecast for FY26, meanwhile, was lowered to 3.7% from 4%, with the GDP growth forecast for the current fiscal year kept steady at a strong 6.5%. The central bank’s move on this front — beyond the ‘dot plots’ — was changing the monetary policy from a description of ‘accommodative’ to ‘neutral’, meaning a more balanced approach going forward is expected.

The immediate market reaction to the RBI’s announcement was, as expected, very positive, especially in rate-sensitive sectors. Sentiment was so strong that the Nifty Bank index hit an all-time high in mid-October, an expression of how much Deutsche Bank expects the government’s moves to accelerate credit growth and banking sector profitability. Other sectors such as Auto, Metals & Realty saw a significant positive impact, with the market participants rejoicing at the promise of reduced borrowing costs to consumers & industries. The rest of the market, as measured by the Nifty Midcap and Smallcap indices sent up the same signals of positive breadth, showing broad enthusiasm in the market.

Also check:- Indian Equities Continue Upward Trend Amidst Optimism for RBI Rate Cut

On the individual stocks, Bajaj Finance and Shriram Finance were major Nifty movers, continuing their bullish run. Maruti Suzuki, Hero MotoCorp, and Axis Bank were the other big contributors to the Nifty’s advance. Stocks such as Tata Steel and Sun Pharma witnessed a bit of profit booking even as the broader market trend stayed strongly bullish.

Foreign Portfolio Investors (FPIs) extended their selling spree on Thursday as well with net sellers of Rs 208 crore. Domestic Institutional Investors (DIIs) came to the rescue once again, as they turned net buyers with a net buying figure of Rs 2,382 crore filling the void created by FPI selling. Indian Rupee, which was trading a touch lower initially traded out huge volatility after the RBI announcement.

Looking forward, the bigger-than-expected rate cut from the RBI will surely act as a major tailwind to the Indian economy and Indian markets. While global factors, including US macroeconomic data and the state of US global trade relations, will certainly continue to be watched, robust domestic policy support should help to maintain strong investor confidence. Consequently, the market is still expecting more of this upward momentum in the short term, with a focus now turning to how these policy moves will affect economic activity and corporate earnings over the next few quarters.